child care tax credit portal

For 2022 that amount reverted to 2000 per child dependent 16 and younger. Be under age 18 at the end of the year.

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

A childs age determines the amount.

. To be eligible for this rebate you must meet all of the following requirements. The enhanced Child Tax Credit CTC was signed into law by President Joe Biden as part of the American Rescue Plan. Not everyone is required to file taxes.

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. The Child Tax Credit provides money to support American families helping them make ends meet. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card.

Ad Access Tax Forms. The effort increases the benefit from a 2000 credit taken annually when you. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

1200 in April 2020. The Child Tax Credit CTC provides financial support to families to help raise their children. To be a qualifying child for the 2021 tax year your dependent generally must.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from. Parents income matters too. The Advance Child Tax Credit Update Portal is now closed.

For children under 6 the amount jumped to 3600. Be your son daughter stepchild eligible foster child brother sister. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

The widget was created for low-income families those earning less than 12400 individually and 24800 for couples who arent required to file a. CNMI Advance Child Tax Credit Update Portal. The Families First Coronavirus Response Leave Act FFCRA can help most businesses even those with only one owneremployee to get compensation for time off because of COVID quarantine and taking care of children out of school.

Complete Edit or Print Tax Forms Instantly. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. You may be eligible for Child Tax Credit payments even if you have not filed taxes recently.

You can check eligibility requirements for stimulus. You must have claimed at least one child as a dependent on your 2021 federal income tax return who was 18 years of age or younger. 600 in December 2020January 2021.

E-File Directly to the IRS. Ad Parents E-File to Get the Credits Deductions You Deserve. The Child Tax Credit helps all families succeed.

You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. The Child Tax Credit will help all families succeed. The maximum child tax credit amount will decrease in 2022.

For the 2021 tax year the CTC is worth. Up to 3600 for each child age 0-5. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

Home of the Free Federal Tax Return. This year Americans were only required to file taxes if they. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

When you claim this credit when filing a tax return you can lower the taxes you owe and potentially increase your refund. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The Employee Retention Tax Credit ERTC is a great opportunity for child care businesses with W-2 employees.

Up to 3000 for each child age 6-17. 1400 in March 2021. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

New Child Tax Credit Tool Makes It Easier To Sign Up For Payments Here S How Nextadvisor With Time

:max_bytes(150000):strip_icc()/IRSForm24412-76e295ec60f541aa91f6fe9494b03057.jpg)

Form 2441 Child And Dependent Care Expenses Definition

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Form 2441 Child And Dependent Care Expenses Definition

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Child Tax Credit What Is The Deadline To Apply For Direct Payments Of Up To 750 Marca

Child Tax Credit And 3rd Stimulus Watch For These Irs Letters 11alive Com

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

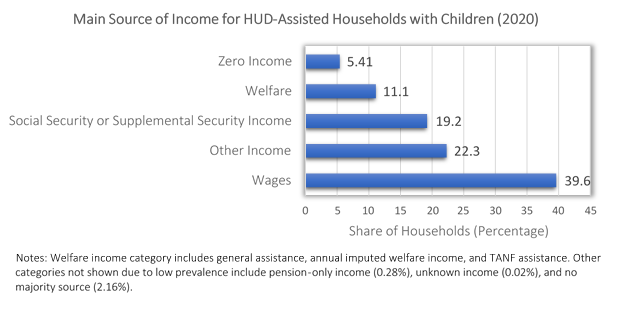

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

New Child Tax Credit Tool Makes It Easier To Sign Up For Payments Here S How Nextadvisor With Time

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

Where Can I Check The Status Of My Payments Getctc

What Is The Child Tax Credit For 2021 Credit Karma

Child Tax Credit And 3rd Stimulus Watch For These Irs Letters 11alive Com

Parents Of 2021 Babies Can Claim Child Tax Credit Payments Here S How Cnet

Stimulus Update How To Request An Irs Trace For Lost Child Tax Credit Payment Gobankingrates

How To Apply For The Connecticut Child Tax Rebate Before The Deadline Sunday Connecticut Public

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User